Investment Shares

A Better Way to Invest

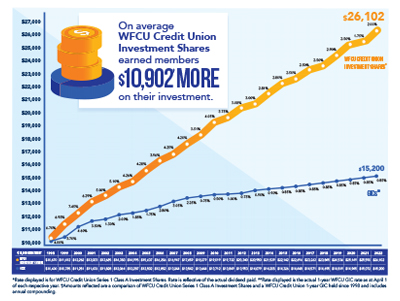

Looking for a premium rate of return? WFCU Credit Union Investment Shares earn a premium rate of return. As a long-term investment, they’re perfect for your TFSA, RRSP or RRIF – plus, there are no fees or commission. Read on to learn why this is just a better way to invest.

How do Investment Shares work?

Investment Shares are a straightforward investment option. Each Investment Share costs $1. There are no commissions or fees associated with purchasing Investment Shares. The minimum purchase is 500 Investment Shares ($500). This can be funded from your WFCU Credit Union account, including your Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), or Registered Retirement Income Fund (RRIF).

What Are the Benefits?

Premium ReturnsOur Investment Shares earn a premium rate of return.

Diversification

If you’re looking to diversify your portfolio while minimizing risks, our Investment Share series is the perfect addition to your holdings.

Stronger Together

When you invest directly with us, it helps strengthen WFCU Credit Union, benefitting all members through innovative banking products and services.

Community Investment

WFCU Credit Union is committed to making the communities we serve the best places to live and work. Investment Shares help support this.

To view the performance of WFCU Investment Shares, click here.

Frequently Asked Questions

What are Investment Shares?

Investment Shares are an excellent, long-term investment option that allows you to directly invest in WFCU Credit Union and earn a premium rate of return

What are the main benefits of Investment Shares?

Investment Shares are ideal if you are seeking a long-term investment to diversify your portfolio. They can produce a premium rate of return, usually exceeding GICs. In fact, compared to five-year GIC investments, WFCU Credit Union Investment Shares have traditionally provided substantially superior returns.

What is the purpose of Investment Shares?

Investment Shares provide additional capital to WFCU Credit Union, enabling us to grow and expand our operations. The funds raised through this offering will be used to add to WFCU’s Regulatory Capital, and provide an increased capital base for the Credit Union’s future growth. Funds raised will enable the Credit Union to continue offering competitively priced and innovative products/services, so members can conduct all of their financial business with the Credit Union.

How does the Investment Share purchase process work?

The process is simple. The minimum allowed purchase is 500 Investment Shares, which equates to $500. This can be funded from your WFCU Credit Union account, including a Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), or Registered Retirement Income Fund (RRIF). You will be given an Offering Statement document which contains all the information needed to make an informed decision about purchasing Investment Shares. Upon completion and submission of the required paperwork, a date of when the Investment Shares will be purchased is provided.

Who can purchase Investment Shares?

Any eligible WFCU Credit Union member is able to purchase Investment Shares. Eligible members include individual members (age 18+), as well as corporations, partnerships, and formal trusts.

Who can become a member?

Membership is open to anyone living or working in Ontario.

Can a personal member purchase Investment Shares jointly?

Yes. Personal members can purchase non-registered Investment Shares singly and/or jointly (maximum of two).

Are Investment Shares insured by the Financial Services Regulatory Authority of Ontario (FSRA)?

Investment Shares are not guaranteed by FSRA. As the actual rate of return with Investment Shares cannot be guaranteed, they are ineligible for FSRA coverage