Chequing

Premier Business Accounts

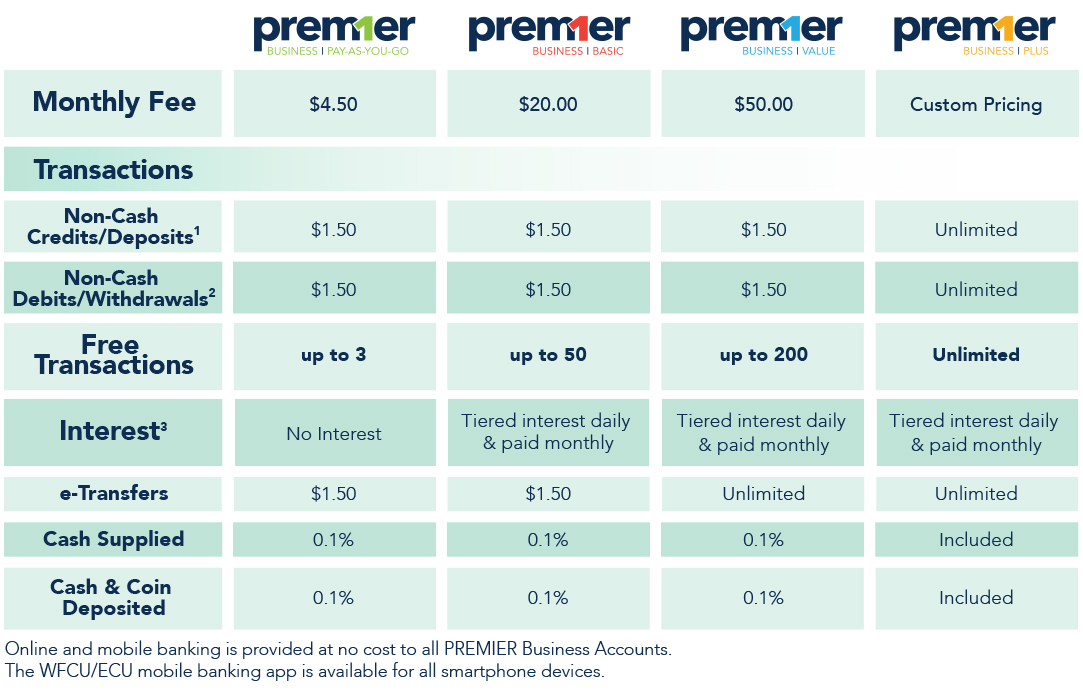

WFCU Credit Union’s suite of Prem1er Business Accounts puts business members in charge, giving them the ability to choose the account that is right for their unique business needs.

From Prem1er Business Pay-As-You-Go to Prem1er Business Plus, our range of business accounts provide tailored solutions based on business size, transactions and goals.

To learn more about all our Prem1er Business Accounts or to discuss which business account is best suited for your needs, please stop by one of our convenient branch locations, or reach us at 519.974.WFCU or by email at info@wfcu.ca.

1Deposits include in branch deposits, ATM deposits, electronic deposits including preauthorized credits, e-transfers received, deposit anywhere cheque deposit and corporate deposit capture.

2Withdrawals include in branch withdrawals, ATM withdrawals, electronic withdrawals including preauthorized debits, point of sale, bill payments & cheques.

3Select PREMIER accounts can earn interest, with interest calculated on the minimum daily balance and paid monthly based on the balance of the following tiers: $0.01 - $74,999 I $75,000 - $149,999 I $150,000 - $299,999 I $300,000+

Overdraft Protection

Available in amounts from $1,000 up to $25,000, the Overdraft Protection is an authorized overdraft attached to a Premier Business Banking account.

U.S. Business Chequing

A daily interest savings account with an option for chequing privileges. Businesses can conveniently deposit U.S. cheques or cash directly into the account without converting to Canadian funds. $1.50 per debit. Interest is calculated daily and paid monthly, based on a tiered structured.

U.S. deposits are not included in the deposit insurance coverage provided by the Deposit Insurance Corporation of Ontario.